WEP, GPO, and The Social Security Fairness Act

Over the course of their careers, my parents both worked for corporations (where their earnings were “covered” and tracked under Social Security and subject to Social Security tax) and Illinois school/university systems (where their earnings were not “covered” or tracked by Social Security and were not subject to Social Security tax). Upon retirement, they were eligible for Social Security benefits due to their Social Security “covered” employment and teacher’s/university pensions due to their “non-covered” employment income. Two sources of guaranteed income during retirement sounds like a windfall, right?

While they were (and still are) collecting both Social Security benefits and teacher’s pensions, their Social Security benefits were not as high as the number reflected on their Social Security statements due to a provision enacted in the 1980s called the Windfall Elimination Provision (WEP).

To understand WEP, it is important to remember that Social Security was designed to replace a higher percentage of income for lower earning workers. However, the Social Security system does not delineate between workers who have low “covered” earnings because they worked in low wage “covered” employment and those whose earnings appear low because they worked in “non-covered” employment potentially earning high salaries. The purpose of WEP was to adjust the Social Security formula to account for those years of “non-covered” local/state government employment that resulted in a pension for the worker.

Another provision, the Government Pension Offset (GPO) was enacted at the same time as WEP. Similar to WEP, the purpose of GPO was to reduce Social Security spousal, divorced spousal, and survivor benefits for those individuals who were receiving pensions from their own “non-covered” employment.

While the intent of WEP and GPO seemed logical when implemented, neither provision was understood by the public and both were extremely unpopular. Many local and state unions have been fighting for years to have WEP and GPO eliminated, and Social Security benefits restored for those impacted. (Note that according to the Social Security Administration, approximately 72% of state and local public employees are “covered” under Social Security and are not impacted by WEP or GPO.)

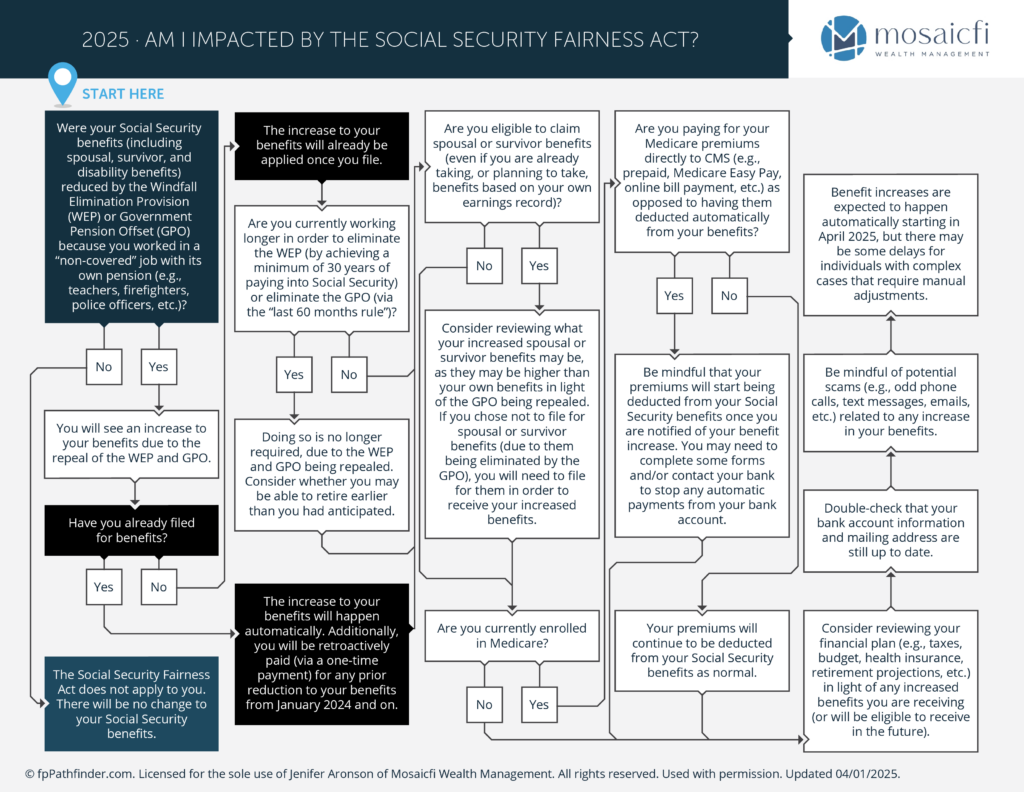

Enter the Social Security Fairness Act, signed into law on January 5, 2025. The Act eliminated WEP and GPO retroactively to January 1, 2024. As a result, workers who were impacted by WEP and receiving both Social Security retirement benefits and a local/state government pension started receiving retroactive lump-sum Social Security payments in March. According to the Social Security administration, the average retroactive payments was $6,710. Increases in monthly Social Security benefits will begin in April.

If you or someone you know was subject to WEP or GPO and has not received any communication from Social Security, below are the steps to take as posted on the Social Security Administration website: https://www.ssa.gov/benefits/retirement/social-security-fairness-act.html

Mosaic FI, LLC is a State of Illinois registered investment adviser. The opinions expressed herein are those of the firm and are subject to change without notice due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of Tammy Wener, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes , April 7, 2025.

Mosaic FI, LLC has provided links to various other websites. While Mosaic FI, LLC believes this information to be current and valuable to its clients, Mosaic FI, LLC provides these links on a strictly informational basis only and cannot be held liable for the accuracy, time sensitive nature, or viability of any information shown on these sites.

share this post

share on facebook

email to a friend

pin to pinterest